In the rapidly evolving Solana DeFi ecosystem, Raydium stands as a pioneering force that has shaped how decentralized trading works on one of crypto’s fastest blockchains. As Solana’s first automated market maker launched in February 2021, Raydium has become foundational infrastructure supporting thousands of trading pairs and new token launches. But what makes this protocol special, and why does RAY token carry an 18.88% APR on iFlux Global’s Token Installment platform? Let’s explore this comprehensive analysis.

What is Raydium?

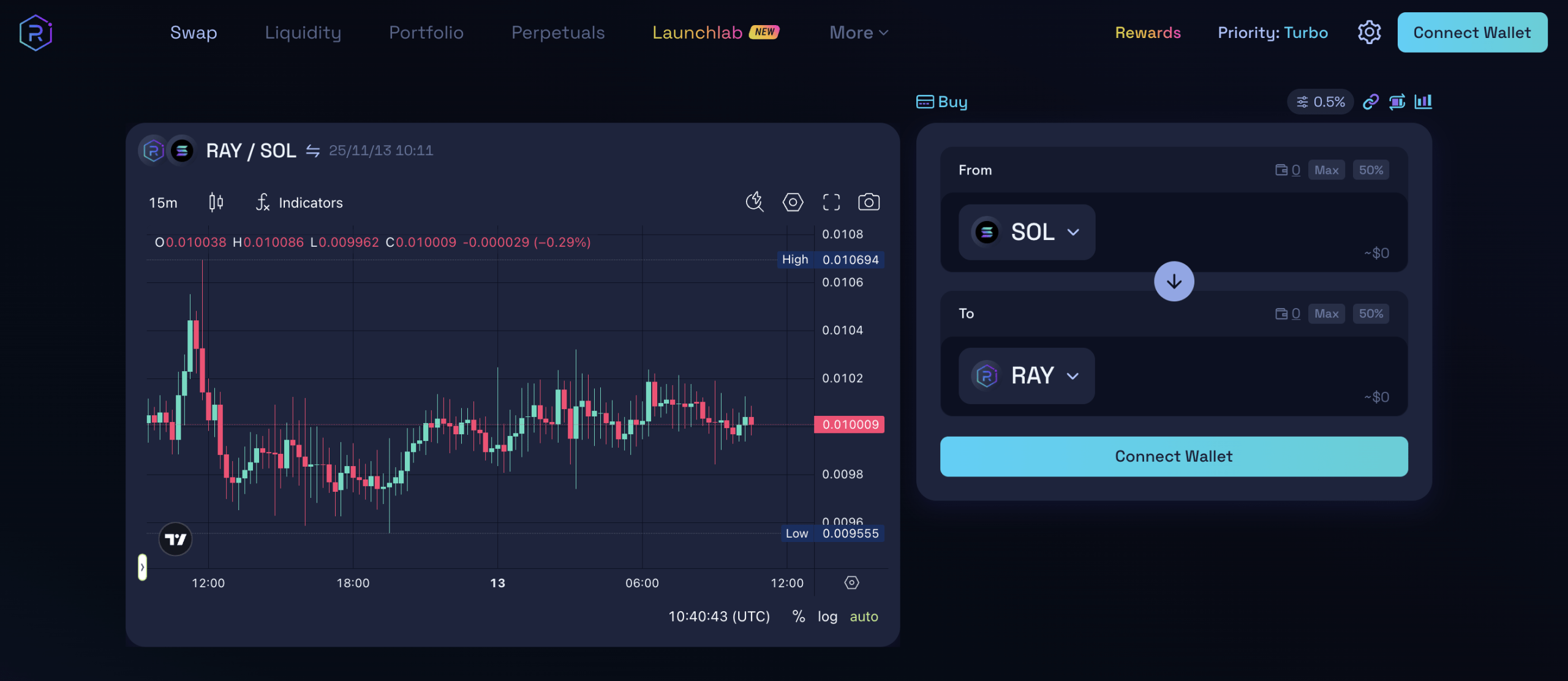

Raydium is an automated market maker (AMM) and decentralized exchange (DEX) built on the Solana blockchain. The platform allows users to trade, provide liquidity, and earn rewards while leveraging Solana’s high-speed infrastructure and low transaction costs.

After launching in February 2021, Raydium has garnered attention for its distinctive features, including its integration with OpenBook, a decentralized order book protocol that offers an edge over traditional AMMs. Raydium plays a notable role in the DeFi ecosystem primarily due to its ability to leverage Solana’s low fees and high transaction speeds.

The Story Behind Raydium

The founding team came from algorithmic trading backgrounds in traditional finance. They entered crypto in 2017 and spent the summer of 2020 deep in DeFi activities on Ethereum. High gas fees and slow transaction times pushed them to look for alternatives. When they discovered Solana’s speed and low costs, they saw an opportunity to build something better.

Building one of the first protocols on Solana meant facing unique obstacles. The team had limited reference code to work from. Only Serum existed on Solana when they started. They built most of their codebase from scratch.

Solana’s rapid development created constant maintenance challenges. Blockchain updates frequently broke working code. The team had to stay flexible and adapt quickly to keep the platform running smoothly.

Key Features of Raydium

Raydium is a DeFi protocol that combines the functionalities of an AMM with those of a centralized order book. Unlike traditional AMMs, which rely solely on liquidity pools for matching trades, Raydium integrates with OpenBook’s central limit order book. This integration allows Raydium to access a broader pool of liquidity and offer better pricing for users.

Built on Solana, Raydium benefits from the blockchain’s high throughput and low transaction costs. Solana’s ability to process thousands of transactions per second positions Raydium as an option for traders and liquidity providers seeking efficiency and scalability.

Their USPs

Fast Transactions

Raydium uses Solana’s high throughput to process thousands of transactions per second with minimal delays.

Low Fees

Solana’s lower transaction costs make Raydium a cost-efficient option for traders and liquidity providers compared to blockchains like Ethereum.

Deep Liquidity

Integration with OpenBook allows Raydium to access a shared liquidity pool, resulting in affordable pricing and reduced slippage.

User-Friendly Interface

The platform offers a simple, easy-to-use interface for trading, farming, and participating in token launches.

How Does Raydium Work?

Automated Market Making (AMM)

Raydium allows users to trade tokens through liquidity pools without requiring a counterparty for each trade. Instead, trades are executed against the liquidity in the pools, with prices determined algorithmically based on supply and demand.

Integration with OpenBook

One of Raydium’s distinct features is its connection to OpenBook’s order book. OpenBook is a fork of an older project called Serum. While most AMMs only offer liquidity within their platform, Raydium provides access to OpenBook’s order book, ensuring deeper liquidity and better prices for traders.

Raydium started with a hybrid model that set it apart from other AMMs. When users added liquidity to a Raydium pool, the platform converted those tokens into limit orders on Serum’s order book. This meant traders could access both AMM liquidity and order book depth in a single swap. The system would automatically find the best price between Raydium’s own pools and the Serum order book.

Serum eventually deprecated, and Raydium now integrates with OpenBook instead. The platform’s legacy AMMv4 pools now function as traditional constant product AMMs without the order book connection.

Yield Farming

Liquidity providers on Raydium can stake their LP tokens in farming pools to earn additional rewards. This incentivizes participation and increases the platform’s overall liquidity.

Three Types of Liquidity Pools

Raydium offers three distinct pool architectures. Each serves specific use cases and trading strategies.

Concentrated Liquidity Market Maker (CLMM) Pools

CLMM pools let liquidity providers allocate their capital within specific price ranges. This creates deeper liquidity around the current market price. LPs can use more sophisticated strategies and earn higher fees on their capital. CLMM works best for less volatile trading pairs where prices stay within predictable ranges.

Constant Product Market Maker (CPMM) Pools

CPMM pools represent Raydium’s latest iteration of the classic K=XY formula. These pools support Token-2022 standards and offer multiple fee configurations. Projects launching new tokens often prefer CPMM for price discovery. The flexibility makes these pools ideal for tokens without established markets.

AMMv4 Pools

AMMv4 pools are Raydium’s battle-tested legacy pools. They remain the most widely distributed program on Solana. Many established trading pairs still use AMMv4 because of its proven reliability and deep existing liquidity.

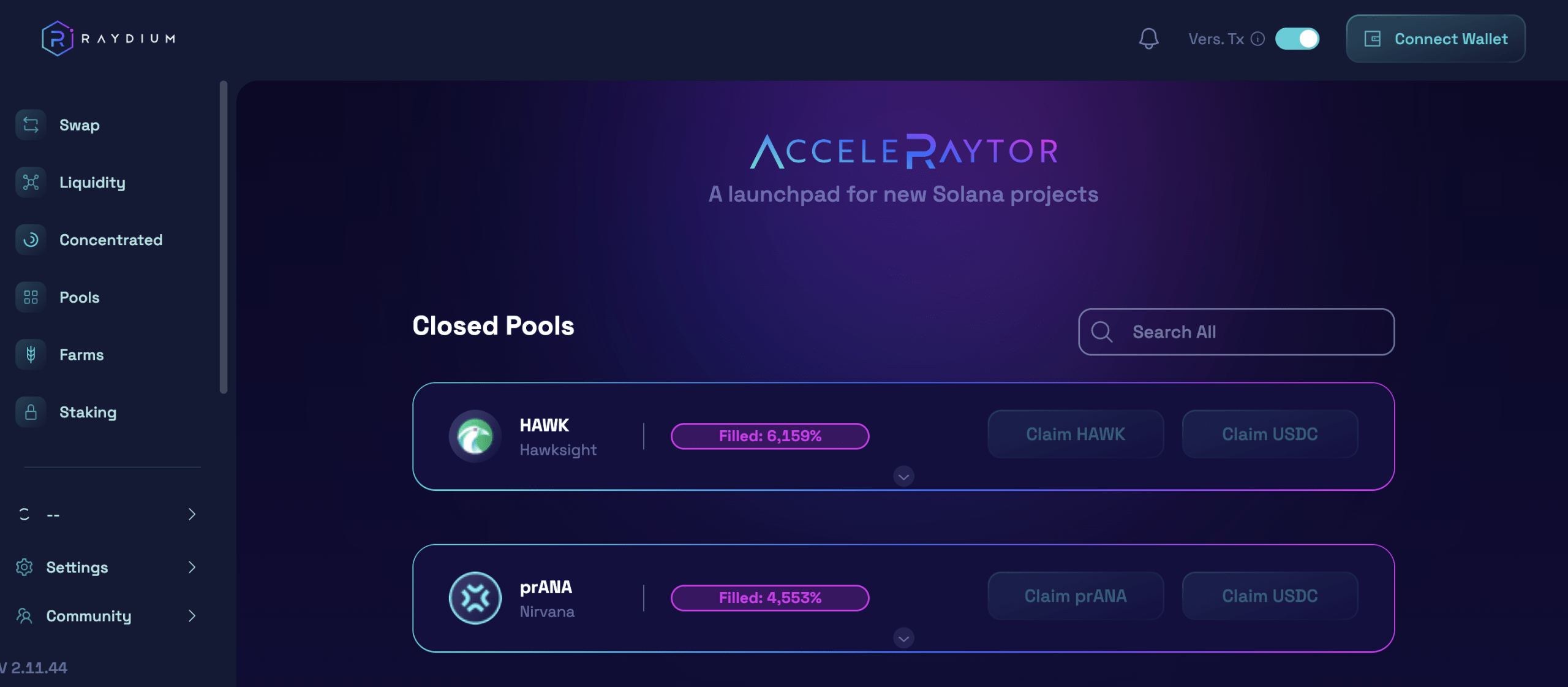

AcceleRaytor: Building the Ecosystem

The AcceleRaytor launchpad launched in April 2021 to address the token shortage problem that plagued early Solana. The platform helps new projects raise capital and establish initial liquidity in a decentralized way. Projects get advisory support from the Raydium team and guaranteed liquidity for trading.

AcceleRaytor offers two pool types:

- Community Pools give broad access to token sales

- RAY Pools reward users who hold and stake the platform’s native token

This structure incentivizes long-term community participation while supporting new project launches.

The first AcceleRaytor project brought unprecedented traffic to Solana. The team had to scale their infrastructure quickly to handle the surge. This early success validated the launchpad concept and helped establish Raydium as a key gateway for new projects entering Solana.

LaunchLab: Competing for Memecoins

On April 16, 2025, Raydium launched LaunchLab. This community-powered token launch platform targets the memecoin market. It competes directly with services like Pump.fun.

LaunchLab gives token creators customizable bonding curves with no migration fees. When a token raises 85 SOL, the platform transitions it instantly to Raydium’s AMM. This leverages Raydium’s established liquidity infrastructure and gives new tokens immediate access to deep markets.

The platform recognizes that memecoins drive significant trading volume on Solana. LaunchLab positions Raydium to capture more of this market segment. It also gives the platform a natural pipeline for new tokens that can eventually graduate to standard trading pools.

Understanding RAY Token: Technical Specifications

Token Key Metrics

- Token Name: Raydium

- Ticker: RAY

- Blockchain: Solana

- Token Type: Utility, Governance

- Total Supply: 555,000,000 RAY

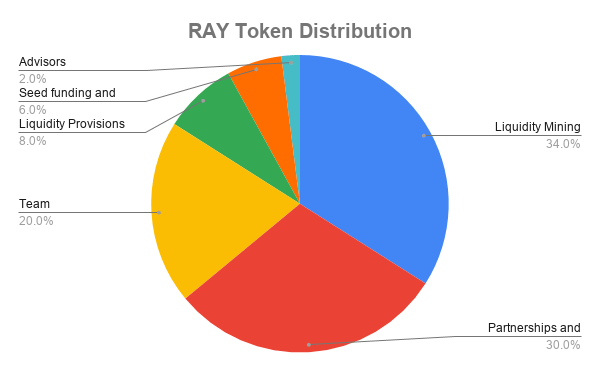

Token Distribution Breakdown

The RAY token distribution reflects a long-term approach to ecosystem development:

- Mining Reserve: 34% (188.7 million)

- Partnership & Ecosystem: 30% (166.5 million)

- Team: 20% (111.0 million)

- Liquidity: 8% (44.4 million)

- Community Pool / Seed: 6% (33.3 million)

- Advisors: 2% (11.1 million)

Token Release Schedule

The team and seed allocations represented 25.9% of total supply. These tokens locked for 12 months after the token generation event. They then unlocked linearly over the following 24 months. This vesting schedule completed on February 21, 2024. All team and seed tokens are now fully unlocked.

How RAY Token Creates Value

RAY serves multiple functions within the Raydium ecosystem, creating various value capture mechanisms:

Staking for Yield

Token holders can stake RAY to earn yield from protocol trading fees. This creates a direct connection between platform usage and token holder rewards. The more trading activity on Raydium, the more fees flow to RAY stakers.

Governance Rights

Staked RAY provides voting power in Raydium’s governance system. The platform uses a limited governance model for community proposals. This gives long-term holders influence over protocol development, ensuring the community has a say in Raydium’s future direction.

Liquidity Mining Incentives

Liquidity mining programs use RAY as incentive rewards. These farming opportunities encourage users to provide liquidity to specific pools. The platform can direct liquidity to new or strategic trading pairs through RAY incentives, ensuring healthy markets for important tokens.

AcceleRaytor Access

AcceleRaytor requires RAY holdings for participation. Users need to stake RAY to access token sales through the launchpad. This creates additional demand for the token beyond trading and governance, as investors seek early access to promising new projects.

Why the 18.88% APR? Understanding Token Installment Interest Rates

When you see an 18.88% APR for RAY on iFlux Global‘s Token Installment platform, it represents a middle ground in the risk-reward spectrum. Let’s break down the factors:

Established Protocol Position

Unlike newer tokens launching with higher APRs, RAY benefits from being Solana’s first AMM with a proven track record since February 2021. The 18.88% APR reflects this established position – it’s higher than Bitcoin (4.67% APR) but lower than newer, more volatile tokens like MOVE (65.23% APR) or ENA (45.76% APR).

Solana Ecosystem Dependency

RAY’s performance is closely tied to Solana’s success. While Solana has proven itself as a high-performance blockchain, it faces:

- Competition from other Layer 1 blockchains

- Occasional network congestion during high activity

- Centralization concerns that some critics raise

The 18.88% APR accounts for this ecosystem-specific risk while recognizing Solana’s strong position in the crypto landscape.

DeFi Protocol Risks

As a DeFi protocol, Raydium faces standard sector risks:

- Smart contract vulnerabilities despite audits

- Competition from other Solana DEXs

- Regulatory uncertainty around decentralized exchanges

- Market volatility affecting trading volumes and fee generation

Value Capture Mechanics

The 18.88% APR also reflects RAY’s strong value capture mechanisms. Unlike pure governance tokens, RAY holders benefit from:

- Trading fee revenue sharing through staking

- RAY buyback programs using protocol fees

- Multiple utility functions creating sustained demand

This diverse utility profile supports a moderate APR that balances opportunity with manageable risk.

Raydium’s Fee Structure and Revenue Distribution

Raydium generates revenue through trading fees, with the fee structure varying based on pool type.

Standard AMMv4 Pools

Standard AMMv4 pools charge 0.25% per trade:

- 0.03% goes to RAY buybacks

- Remaining fees go to liquidity providers

CPMM and CLMM Pools

CPMM and CLMM pools use multiple fee tiers ranging from 0.01% to 4%. These pools split fees three ways:

- Liquidity providers receive 84% of fees

- RAY buybacks get 12% of fees

- Protocol treasury receives 4% of fees

Pool Creation Costs

Creating a standard AMM or CP-Swap pool costs 0.15 SOL. This fee prevents spam pool creation and ensures only serious projects and traders create new markets.

The platform uses buyback fees to purchase RAY from the open market at regular intervals. This creates constant buy pressure for the token and reduces circulating supply over time, benefiting long-term holders.

The Team Behind Raydium

Three pseudonymous co-founders lead Raydium. Their backgrounds in algorithmic trading and low-latency systems gave them the technical skills to build on Solana from day one.

AlphaRay handles strategy, operations, product direction, and business development. He worked in algorithmic trading for commodities before moving to crypto market-making in 2017. His DeFi experiences in 2020 led directly to the concept for Raydium.

XRay serves as Chief of Technology and leads the development team. He brings eight years of experience building trading systems and low-latency architectures in both traditional finance and crypto markets.

GammaRay leads marketing and communications while contributing to strategy and product decisions. His background in data analytics and market research helps shape how Raydium presents itself to users and partners.

How to Profit Using iFlux Global’s Token Installment

Understanding the 18.88% APR and Raydium’s fundamentals, here’s how investors can strategically use iFlux Global‘s Token Installment feature:

Capital Efficiency Strategy

Instead of paying 100% upfront for RAY tokens, you can:

- Pay just 15% upfront to gain exposure to RAY’s governance rights and fee-sharing

- Spread remaining payments over 10 days to 12 months

- Free up capital to provide liquidity on Raydium or participate in other opportunities

Example Calculation: If you want to acquire $10,000 worth of RAY:

- Traditional purchase: $10,000 upfront

- iFlux Installment: $1,500 upfront (15%), with remaining balance paid over your chosen term

Managing the 18.88% APR

The 18.88% APR is moderate compared to other tokens on iFlux, reflecting RAY’s established position:

Interest Payment Structure

For a 6-month installment on RAY purchased with USDT (19.68% APR for USDT payments):

- Borrowed amount: $8,500 (85% of $10,000)

- Interest over 6 months: $8,500 × 19.68% × 0.5 = $836.40

- Monthly cost: approximately $139.40

Ecosystem Participation Offset

Here’s where Raydium’s ecosystem creates opportunities:

- Stake unlocked RAY tokens to earn protocol trading fees

- Provide liquidity to Raydium pools for additional yield

- Participate in yield farming programs earning RAY rewards

- Access AcceleRaytor token launches with staked RAY

Risk Management Through Zero Liquidation

Unlike leveraged trading where price drops can force liquidation, iFlux Global’s Token Installment offers zero liquidation risk. This is particularly valuable for DeFi governance tokens like RAY because:

- You won’t lose your position during market corrections

- You can maintain long-term participation in Raydium’s growth

- Your RAY tokens gradually unlock as you make payments

Token Unlock Schedule Advantage

Remember that RAY tokens unlock gradually after each installment payment:

- After upfront payment: 4.25% of your RAY (unlocked after 12 hours)

- After payment 1: Additional 4.25%

- After payments 2-9: Additional 8.5% each

- After final payment: Remaining 23.5% (including your initial upfront portion)

This structure allows you to:

- Stake unlocked tokens immediately to earn trading fees

- Provide liquidity to Raydium pools with accumulated RAY

- Participate in governance decisions as your position grows

- Access AcceleRaytor launches with staked tokens

Investment Considerations

Opportunities

First-Mover Advantage on Solana

- Launched February 2021 as Solana’s first AMM

- Most widely distributed program on Solana

- Established brand recognition and user trust

- Deep liquidity across thousands of trading pairs

Strong Value Capture Mechanisms

- Trading fee revenue sharing with RAY stakers

- Continuous RAY buyback program reducing supply

- Multiple fee tiers generating diverse revenue streams

- AcceleRaytor creating additional RAY demand

Ecosystem Infrastructure Position

- AcceleRaytor has launched numerous successful Solana projects

- LaunchLab capturing memecoin launch market

- Integration with OpenBook providing order book liquidity

- Three pool types serving different market needs

Solana’s Growth Trajectory

- High-performance blockchain with low fees

- Growing DeFi ecosystem and user base

- Institutional adoption increasing

- Strong developer community

Risks to Consider

Solana-Specific Risks

- Performance dependent on Solana network health

- Centralization concerns about Solana validator set

- Competition from other Solana DEXs (Orca, Phoenix)

- Network congestion during high-activity periods

DeFi Protocol Risks

- Smart contract vulnerabilities despite audits

- Economic exploit possibilities

- Regulatory uncertainty around DEXs

- Impermanent loss risk for liquidity providers

Competitive Pressures

- Jupiter aggregator routing trades to best prices

- New AMM innovations from competitors

- Memecoin platforms like Pump.fun competing for volume

- Cross-chain DEXs attracting liquidity

Market Risks

- 18.88% APR reflects moderate but real volatility

- RAY price correlation with Solana ecosystem health

- Trading volume fluctuations affecting fee revenue

- Broader crypto market conditions

Smart Trading Strategy with iFlux Global

For investors interested in RAY, here’s a strategic approach using iFlux Global’s features:

1. DeFi Ecosystem Participation

Build comprehensive Raydium exposure:

- Use Token Installment for RAY governance token (15% upfront)

- Stake unlocked RAY to earn trading fee revenue

- Provide liquidity to select Raydium pools

- Participate in yield farming for additional RAY rewards

2. Launchpad Access Strategy

Position for AcceleRaytor opportunities:

- Accumulate RAY gradually through installments

- Stake tokens to qualify for RAY Pool allocations

- Access early-stage Solana project launches

- Diversify across multiple launchpad investments

3. Fee Revenue Optimization

Maximize returns from protocol activity:

- Monitor trading volumes across pool types

- Stake RAY when fee revenue is high

- Consider LP positions in high-volume pairs

- Reinvest earned fees to compound returns

4. Solana Ecosystem Bet

Position RAY as Solana exposure:

- Benefit from Solana’s growth through RAY

- Lower volatility than buying SOL directly

- Exposure to DeFi activity specifically

- Governance rights over major Solana DEX

Real-World Example: Building RAY Position with Ecosystem Participation

Let’s walk through a complete strategy:

Initial Setup

- Open $10,000 RAY installment contract ($1,500 upfront, 6-month term)

- Total interest over 6 months: $836.40

- Monthly payment: ~$139.40

Month 1-2: Begin Staking

- Unlock 8.5% of RAY position (0.085 × $10,000 = $850 worth)

- Stake unlocked RAY for fee revenue

- Assume 5% APY from protocol fees: $850 × 5% ÷ 12 = ~$3.54/month

Month 3-4: Increase Position

- Unlock additional 17% of position (cumulative 25.5%)

- Staked value now $2,550

- Monthly fee revenue: $2,550 × 5% ÷ 12 = ~$10.63/month

Month 5-6: Maximize Participation

- Unlock additional 17% (cumulative 42.5%)

- Staked value now $4,250

- Monthly fee revenue: $4,250 × 5% ÷ 12 = ~$17.71/month

Final Payment: Full Unlock

- Receive final 57.5% including initial upfront

- Total RAY position: $10,000 (at original price)

Outcome Analysis:

- Total interest paid: $836.40

- Fee revenue earned (6 months average): ~$60

- Net cost: $776.40

- If RAY appreciates 25%: Position worth $12,500

- Profit: $12,500 – $10,000 – $776.40 = $1,723.60

This demonstrates how combining installment purchasing with ecosystem participation can create attractive risk-adjusted returns.

Future Development Plans

AlphaRay has outlined several potential directions for Raydium’s growth:

Cross-Chain Expansion

Cross-chain expansion remains on the table. The team is open to building on blockchains like Avalanche, Cosmos, and Polkadot. But Solana remains the primary focus for now.

Interoperability Features

Interoperability features could enhance Raydium’s utility. The team is exploring tools like the Wormhole bridge for cross-chain interactions. Partnerships with platforms like SushiSwap could bring additional liquidity and users to the ecosystem.

NFT Integration

NFT integration represents another potential growth area. The team is considering NFT features and markets. Solana’s NFT ecosystem has grown significantly since Raydium’s launch. Integration could open new revenue streams and use cases for the platform.

What Raydium Means for Solana DeFi

Raydium established itself as foundational infrastructure for Solana’s DeFi ecosystem. The platform provides essential liquidity for thousands of trading pairs. New projects often launch on Raydium first because of its deep liquidity and established user base.

The AcceleRaytor launchpad helped bootstrap the early Solana ecosystem. It gave new projects a clear path to launch tokens and establish markets. This infrastructure attracted more developers and projects to build on Solana.

LaunchLab shows Raydium continues innovating to meet market needs. The platform adapts to new trends like memecoin launches while maintaining its core trading infrastructure. This flexibility helps Raydium stay relevant as Solana DeFi evolves.

The protocol’s fee generation and RAY buyback mechanism create sustainable economics. Trading volume directly benefits RAY holders through staking rewards and reduced supply. This alignment between platform success and token value gives stakeholders long-term incentives to support the ecosystem.

Challenges and Considerations

Raydium, like many DeFi platforms, faces several common hurdles:

Centralization Concerns

Solana’s speed and efficiency are advantages, but some argue that its level of centralization could create risks for projects like Raydium.

Competition

The DeFi space is crowded, with many AMMs and DEXs fighting for users and market share. On Solana alone, Raydium competes with Orca, Phoenix, and other DEXs.

Regulation

As governments focus more on DeFi, platforms like Raydium may face new compliance challenges that could impact operations.

Conclusion: Is RAY Worth the 18.88% APR?

Raydium represents a foundational piece of Solana’s DeFi infrastructure with a proven track record since February 2021. As Solana’s first AMM, the protocol has demonstrated resilience through market cycles and maintained its position as the most widely distributed program on the blockchain. The 18.88% APR on iFlux Global’s Token Installment platform reflects RAY’s moderate risk profile – more established than new token launches but with growth potential tied to Solana’s success.

For the right investor, this could be an opportunity:

- If you believe in Solana’s long-term potential as a high-performance blockchain

- If you want exposure to DeFi trading volume on one of crypto’s fastest-growing ecosystems

- If you value multiple revenue streams (trading fees, staking, farming, launchpad access)

- If you prefer established protocols with proven technology over newer, riskier alternatives

The key is understanding that the 18.88% APR reflects RAY’s balanced position – it’s higher than Bitcoin due to DeFi protocol risks, but lower than newer tokens because of Raydium’s established market position. By using iFlux Global’s Token Installment with features like zero liquidation risk, flexible payment terms, and gradual token unlocking, you can strategically position yourself in Raydium’s ecosystem while managing capital efficiently.

Moreover, the opportunity to immediately stake unlocked RAY tokens and earn protocol trading fees creates a natural offset to installment costs – a unique advantage when investing in DeFi governance tokens with direct fee-sharing mechanisms.

As always, conduct your own research, only invest what you can afford to lose, and consider your personal risk tolerance before making investment decisions.