In the volatile cryptocurrency market, portfolio diversification isn’t just a strategy—it’s a crucial element for long-term success. As the crypto market continues to evolve, understanding how to build and maintain a diversified portfolio has become more important than ever.

Why Diversify Your Crypto Portfolio?

Portfolio diversification in cryptocurrency serves as a powerful risk management tool while optimizing potential returns. In today’s dynamic market, the principle of “not putting all your eggs in one basket” becomes particularly crucial for several reasons:

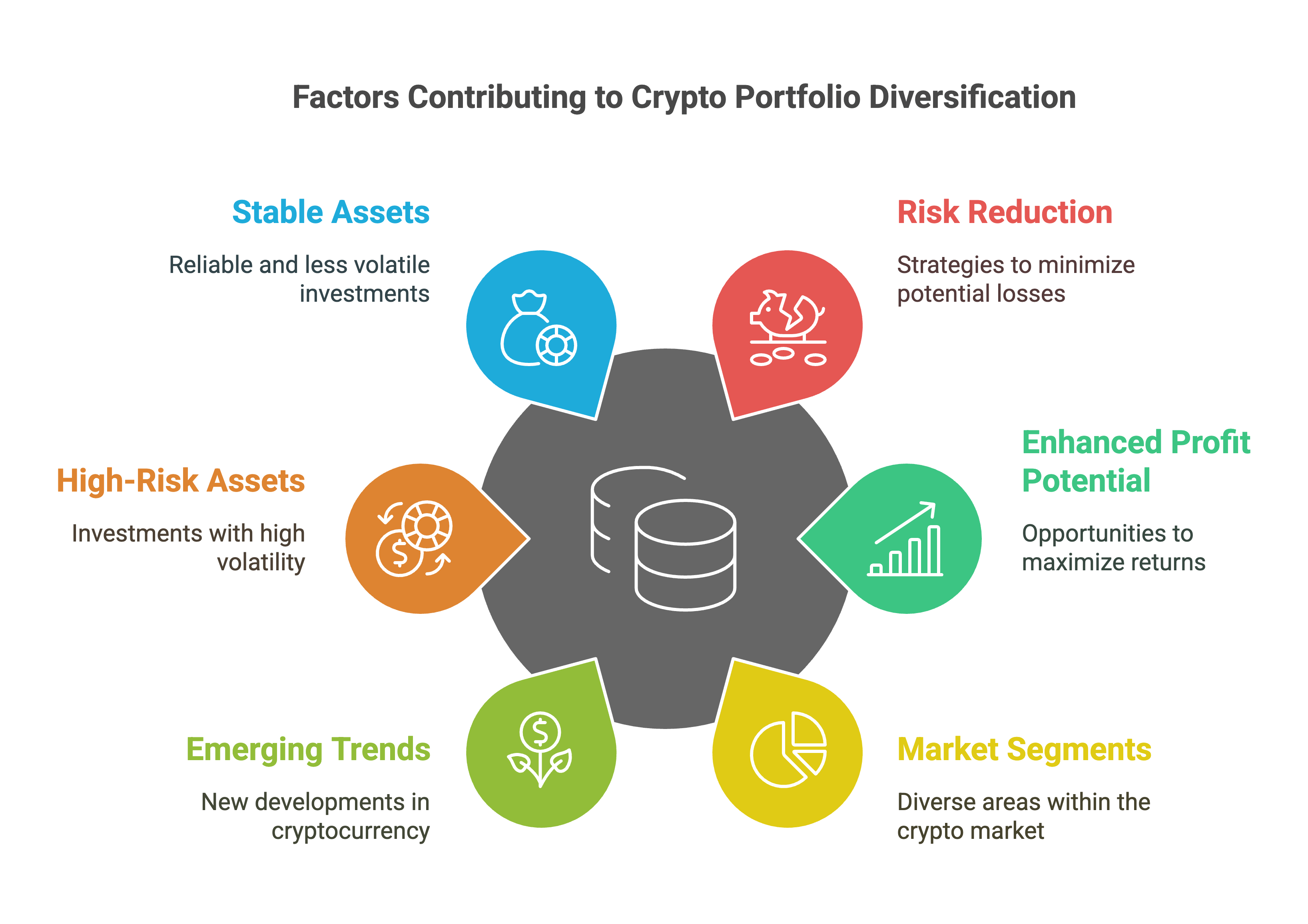

Risk Reduction

- Minimize losses if one project faces issues

- Spread market risk across different assets

- Protection against extreme market movements

- Buffer against regulatory changes

Enhanced Profit Potential

- Capture opportunities across market segments

- Take advantage of emerging trends

- Balance between high-risk and stable assets

- Leverage different market cycles

Effective Diversification Methods

1. Asset Type Allocation

Distribute your portfolio across major cryptocurrency categories:

- Layer 1 Blockchains (Bitcoin, Ethereum)

- DeFi tokens (Uniswap, Aave)

- GameFi and Metaverse projects

- Infrastructure solutions

- Stablecoins for risk management

Start with established cryptocurrencies and gradually expand into other categories as you become more familiar with the market.

2. Market Cap Distribution

Balance your portfolio across different market capitalizations:

- Large-cap: 40-50% of portfolio (lower risk, established projects)

- Mid-cap: 30-40% of portfolio (growth potential with moderate risk)

- Small-cap: 10-20% of portfolio (high risk, high reward potential)

Remember to adjust these percentages based on your risk tolerance and market conditions.

3. Investment Timeline Allocation

Build strategies across different time horizons:

- Short-term: Trading and volatility opportunities

- Mid-term: Accumulating promising projects

- Long-term: Holding foundation projects

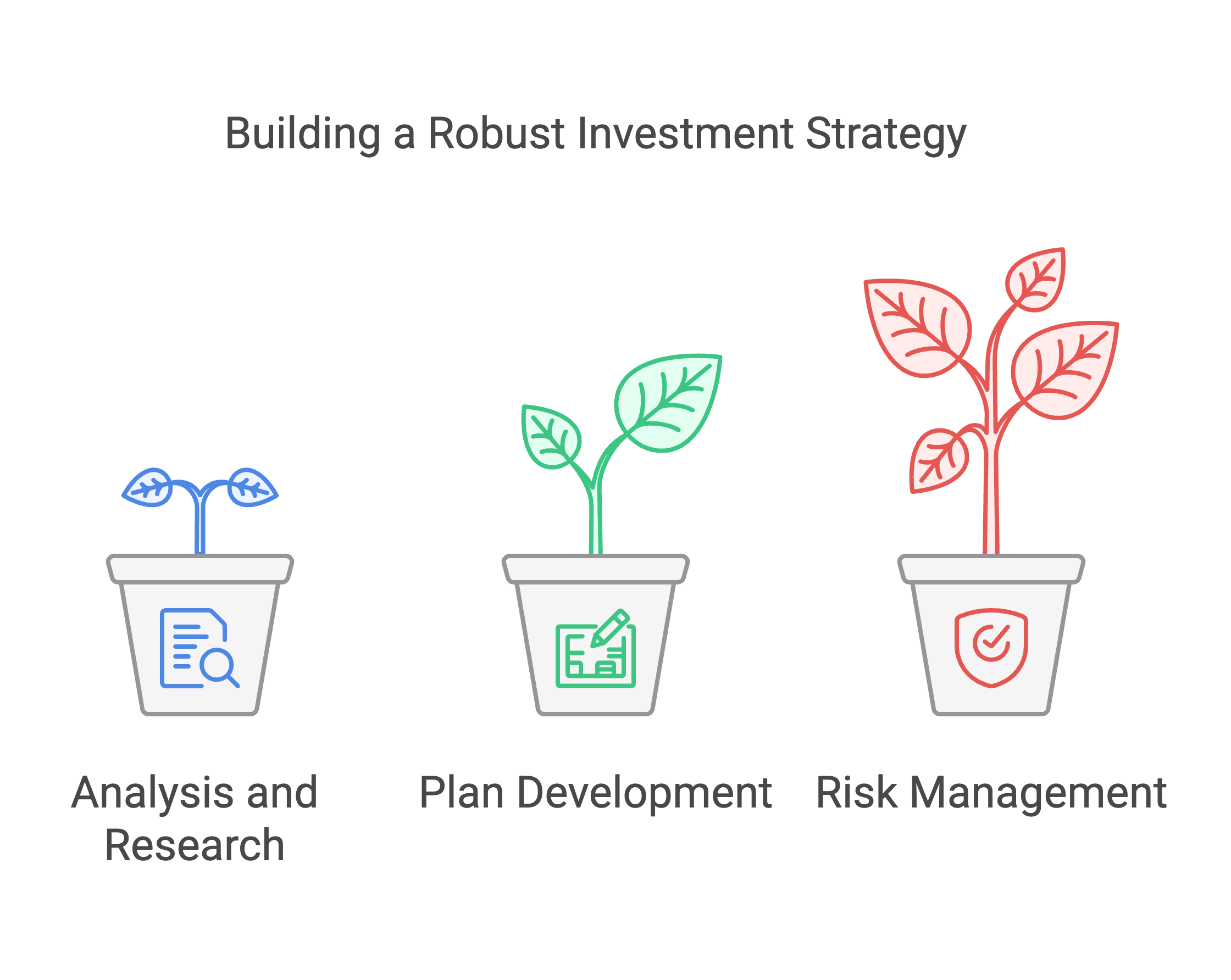

Implementation Strategy

Step 1: Analysis and Research

- Evaluate each project’s fundamentals

- Monitor market trends and sentiment

- Update information from reliable sources

- Assess team experience and project roadmap

Step 2: Plan Development

- Define clear investment objectives

- Set specific allocation ratios

- Create a rebalancing schedule

- Establish entry and exit strategies

Step 3: Risk Management

- Set stop-losses for trading positions

- Maintain appropriate stablecoin reserves

- Regular portfolio assessment

- Document your investment decisions

Important Considerations

Avoid Common Mistakes

- Chasing trending projects without research

- Over-investing in single assets

- Neglecting regular portfolio reviews

- Letting emotions drive decisions

Monitoring and Adjustments

- Regular performance reviews

- Strategy updates based on market conditions

- Rebalancing when allocations drift

- Documenting lessons learned

Getting Started

Building a diversified crypto portfolio is now more accessible than ever. With platforms like iFlux Global, you can start your investment journey with flexible options that suit your financial goals and risk tolerance.

Core Platform Benefits:

- Zero liquidation risk on investments

- No transaction fees

- Unlimited withdrawal capabilities

- Flexible payment options

- Fixed token rates

- Secure escrow mechanism

Whether you’re looking to start your cryptocurrency journey or expand your existing portfolio, iFlux Global offers a robust solution that combines flexibility, security, and innovation. By understanding its features and following the simple setup process, you can begin leveraging this platform’s benefits for your cryptocurrency investments.

Conclusion

Diversifying your crypto portfolio is essential for building sustainable long-term investments. By applying these principles intelligently and staying disciplined, you can minimize risks while optimizing profit opportunities in the volatile crypto market.

Remember that there’s no fixed formula for diversification—your strategy should align with your investment goals, risk tolerance, and personal circumstances. Regular evaluation and portfolio adjustment are key to maintaining a healthy investment portfolio over time.

Ready to start building your diversified crypto portfolio? Begin by assessing your current holdings and implementing these strategies gradually for a more balanced investment approach.

About iFlux Global

iFlux Global democratizes access to advanced financial services, enabling everyone to access sophisticated crypto investment tools anywhere, anytime. Our platform offers comprehensive solutions designed to help crypto investors maximize their profit potential.